Paytm Payments Bank: Impact of SIP payments visible on investors, these big funds have invested money in Paytm

Paytm Payments Bank - Impact of SIP payments visible on investors, these big funds have invested money in Paytm

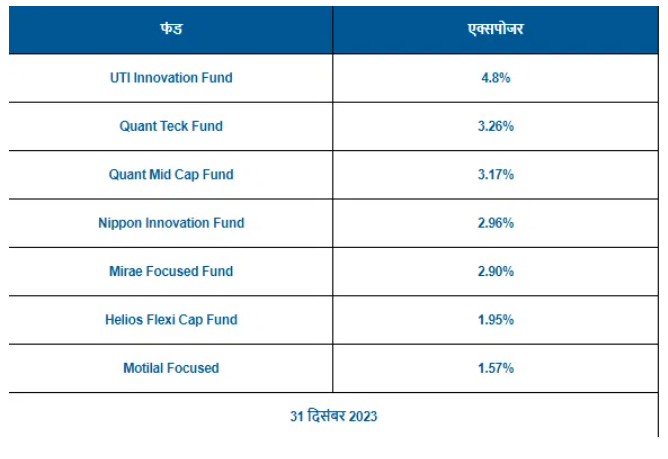

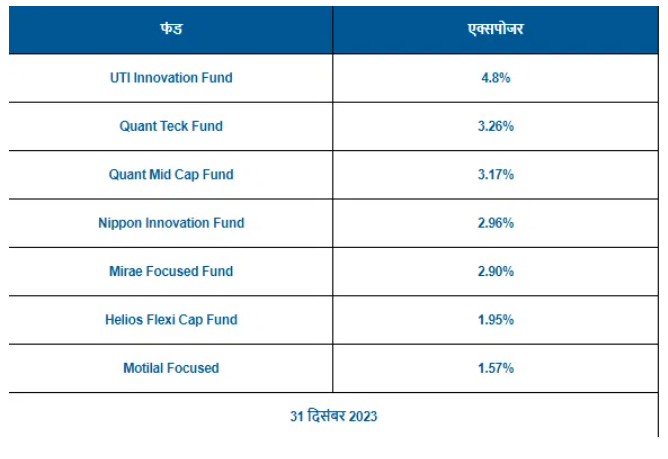

Paytm Payments Bank: RBI has taken a stab at Paytm, the country's largest payments bank. Due to which now there is constant concern among investors about the future of this company. Many big funds have invested their money in Paytm. Paytm has a huge exposure from stock market to mutual funds. In such a situation, if you have also invested in SIP, then it is very important for you to know which big funds have invested your money in Paytm.Paytm's parent company One97 Communications has a total exposure of Rs 1995 crore in mutual funds till December 31, 2023. However, this accounts for only 0.06% of the total assets under management. Let us know if your SIP fund has also been invested in Paytm.Paytm money in 68 mutual fundsA total of 68 mutual fund schemes have an exposure of Rs 1995 crore in Paytm. Between September to December 2023, mutual funds have increased their holding in this company by a total of 77%. Active schemes have more allocation in this company compared to passive schemes. Talking about active funds with highest exposure in Paytm, UTI Innovation Fund tops the list, followed by 4.8%. Apart from this, Quant Mutual Funds has a total stake of 6.43% in two schemes. This information has been found in the report of the brokerage firm.These funds have invested the most money

Shares fell 36% in 2 daysActually, RBI has imposed several bans on Paytm Payments Bank due to violation of regulatory rules. After this announcement, there has been a decline of about 36% in Paytm shares. This decline has happened in just two days. Lower circuits of 20% were seen on the stock on both the days. At the same time, the impact on Paytm's shares can be seen even today. RBI said in its order that Paytm cannot add new customers. Also, no deposit or credit transaction can be done after 29 February 2024. After February 29, this company will not be able to provide any banking service including any kind of fund transfer. After this order of RBI, the company has estimated that it may see an impact of ₹ 300 - ₹ 500 crore on their EBITDA.

Shares fell 36% in 2 daysActually, RBI has imposed several bans on Paytm Payments Bank due to violation of regulatory rules. After this announcement, there has been a decline of about 36% in Paytm shares. This decline has happened in just two days. Lower circuits of 20% were seen on the stock on both the days. At the same time, the impact on Paytm's shares can be seen even today. RBI said in its order that Paytm cannot add new customers. Also, no deposit or credit transaction can be done after 29 February 2024. After February 29, this company will not be able to provide any banking service including any kind of fund transfer. After this order of RBI, the company has estimated that it may see an impact of ₹ 300 - ₹ 500 crore on their EBITDA.