Punjab National Bank (PNB), one of India's largest public sector banks, has recently disclosed a significant loan fraud amounting to Rs 2,434 crore to the Reserve Bank of India (RBI). This revelation underscores the ongoing challenges within the banking sector concerning financial irregularities, even as PNB has taken proactive measures to safeguard its financial position against this particular incident.

Detailed Breakdown of the Fraudulent Activities

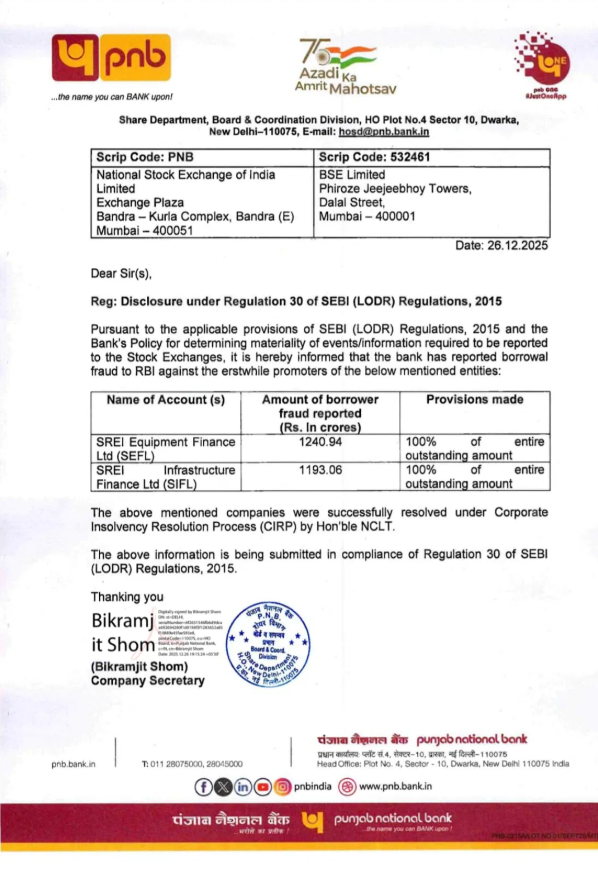

This substantial fraud is linked to two entities within the SREI Group: SREI Equipment Finance and SREI Infrastructure Finance. According to the information provided by PNB to the stock exchanges, the fraud associated with SREI Equipment Finance accounts for approximately Rs 1,241 crore, while the amount related to SREI Infrastructure Finance is around Rs 1,193 crore, while the bank has indicated that the old promoters of these companies were involved in the alleged fraudulent activities, which led to financial losses for the bank.

PNB's Proactive Financial Safeguards and Provisioning

Despite reporting this large-scale fraud, PNB has reassured its investors and customers by stating that it has already made a 100% provision for the entire outstanding amount involved in these two cases, while provisioning in banking refers to the practice of setting aside a portion of profits to cover potential future losses from non-performing assets or frauds. A 100% provisioning signifies that the bank has fully accounted for the potential loss from this fraud, meaning there will be no direct or adverse impact on its current financial statements. This strategic move highlights the bank's solid financial management policies and its capability to mitigate risks effectively.

NARCL's Intervention and Board Reconstitution

The cases involving both SREI Group companies were addressed under the Corporate Insolvency Resolution Process (CIRP) through the National Company Law Tribunal (NCLT). The NCLT is a quasi-judicial body in India that handles matters related to Indian companies, particularly those concerning insolvency and resolution processes under the Insolvency and Bankruptcy Code. This process involved a structured approach to find a resolution for the companies' financial distress. Ultimately, the resolution for these companies was approved, marking the culmination of a complex legal and financial procedure aimed at restructuring their liabilities.

In August 2023, the resolution plan put forth by the National Asset Reconstruction Company (NARCL) received approval, leading to the reconstitution of the boards of the SREI Group companies. NARCL, often referred to as a 'bad bank,' was established to acquire and resolve stressed assets (Non-Performing Assets) from commercial banks. The approval of NARCL's plan provided a clear path forward for the financial restructuring and future direction of the SREI Group, aiming to ensure greater transparency and accountability in their operations moving ahead.

The Rise and Fall of the SREI Group

The SREI Group ventured into the finance sector in 1989 and quickly established a strong foothold, particularly in financing construction equipment. The company played a significant role in India's infrastructure development by providing financial assistance for equipment procurement in the construction sector. However, due to instances of 'wrong financial management and heavy defaults,' the company faced insolvency proceedings in October 2021. This event serves as a critical reminder of the importance of corporate governance and stringent financial discipline in the corporate world.

Punjab National Bank's Current Financial Health

Notwithstanding the fraud disclosure, PNB's overall financial health remains strong. The bank reported that its provision for the September quarter stood at. Rs 643 crore, which is higher compared to the same period last year. This increased provisioning reflects the bank's prudence and its preparedness for future risks. Also, the bank's Provision Coverage Ratio (PCR) has improved Importantly, reaching 96. 91%. A high PCR is a crucial indicator of a bank's asset quality, demonstrating that the bank has adequately provisioned for a substantial portion of its non-performing assets, thereby indicating a strong capacity to absorb potential losses.

PNB's Performance in the Stock Market

In the stock market, PNB's shares closed with a slight decline of 0, while 50% at Rs 120. 35 prior to the fraud disclosure. However, over the longer term, the bank's stock has delivered impressive returns to investors. Year-to-date, the stock has seen an increase of approximately 17%, reflecting growing investor confidence. What's more, over the past three years, the stock has generated an impressive return of 144%, making it an attractive investment option. The company's market capitalization was recorded at Rs 1,39,007 crore, underscoring its significant position within the Indian banking sector, while this performance highlights PNB's inherent strength and market acceptance, even as it navigates through such fraud cases.

Conclusion: Reassuring Stability Amidst Challenges

Ultimately, while the reporting of a significant loan fraud by Punjab National Bank is a serious matter, the bank's proactive measure of 100% provisioning for the entire amount, coupled with the resolution through NCLT and NARCL, demonstrates its commitment to maintaining financial stability. PNB's strong financial indicators, including its improved Provision Coverage Ratio and positive stock market performance, further reassure stakeholders of its resilience and solid operational framework, ensuring that the bank remains a stable and reliable institution despite facing such challenges.