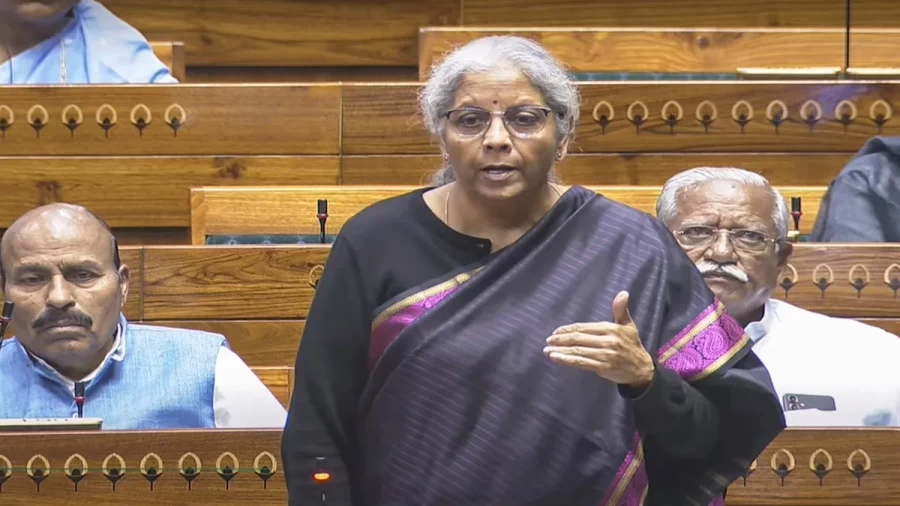

Income Tax Bill 2025: Finance Minister Nirmala Sitharaman on Friday announced the withdrawal of the Income Tax Bill, 2025 in the Lok Sabha. The decision has been taken to incorporate the suggestions of the select committee and remove the confusion arising from various versions of the bill. According to government sources, a revised and clarified bill will be introduced in the House on August 11.

Reason for bill withdrawal

According to a PTI report, the government has taken this step to end the confusion caused by several versions of the Income Tax Bill, 2025 and to incorporate all the reforms. The new bill is designed with the aim of completely replacing the old Income Tax Act of 1961. The government aims to make the tax system more transparent and accessible to taxpayers.

Key suggestions of the select committee

The 31-member select committee has made several important suggestions to make the bill more effective, including:

Tax exemption to religious trusts: The committee has suggested that tax exemption be continued on anonymous donations received by religious and less-religious trusts. This provision will provide financial relief to religious trusts.

Flexibility in TDS refund: Taxpayers should be allowed to claim TDS refund without paying penalty even after the last date for filing income tax return (ITR). This move will further simplify the process for taxpayers.

Relief for non-profit organizations

The amended bill has given special attention to non-profit organizations. The government has made a provision to provide tax exemption only on anonymous donations received by religious trusts. However, if a religious trust runs a hospital, school or other charitable activities, then tax will be applicable on such donations. This provision has been made to maintain a balance between religious and charitable activities.

Way forward

The amended Income Tax Bill, 2025 is expected to be introduced in the Lok Sabha on August 11. This bill can prove to be an important step towards bringing transparency and simplicity in the tax system as well as providing relief to non-profit organizations and taxpayers. Experts believe that incorporating the suggestions of the select committee will make the bill more inclusive and effective.