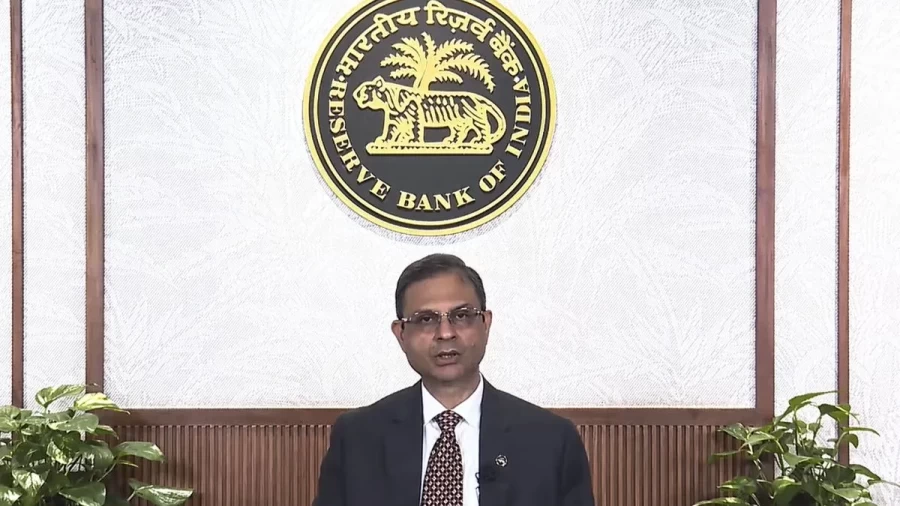

Reserve Bank Of India: Reserve Bank Of India (RBI) Governor Sanjay Malhotra recently made an important statement at a function organized on financial inclusion at Gojaria Gram Panchayat in Mehsana district of Gujarat. He clarified that banks have the freedom to fix the minimum balance for their savings accounts, and the subject is outside the regulatory purview of the RBI. On the question of increasing the minimum balance by a private bank, Malhotra said, "RBI has left the decision of minimum balance to the banks.

Some banks keep it at Rs 10,000, some at Rs 2,000, and some have exempted customers from it." ICICI Bank increased minimum balance ICICI Bank has significantly increased the minimum average monthly balance (MAB) for new savings accounts from August 1, 2025. According to the bank's website, the limit has been increased from Rs 10,000 to Rs 50,000 in urban areas. For small towns and rural areas, this amount has been fixed at Rs 25,000 and Rs 10,000 respectively. On the other hand, State Bank of India (SBI) has decided to exempt savings account holders from penalty for not maintaining minimum balance, which is a relief for customers.

Digital Literacy: The Basis of New Progress

Malhotra stressed the importance of digital literacy in his address. He said, "Earlier education was considered the basis of progress, but in today's era digital literacy is equally important. Without it progress is not possible." This statement underlines the need for financial inclusion and technological awareness in the digital age.

Financial Inclusion and Jan Dhan Yojana

The RBI Governor stressed that the benefits of policies and decisions should reach the lowest sections of the society. Referring to the Pradhan Mantri Jan Dhan Yojana, he said that it was started about 10-11 years ago with this objective, so that every person can get access to banking services. In this context, Devdutt Chand, Managing Director and CEO, Bank of Baroda, emphasised the need for regular updating of Know Your Customer (KYC) for Jan Dhan accounts.