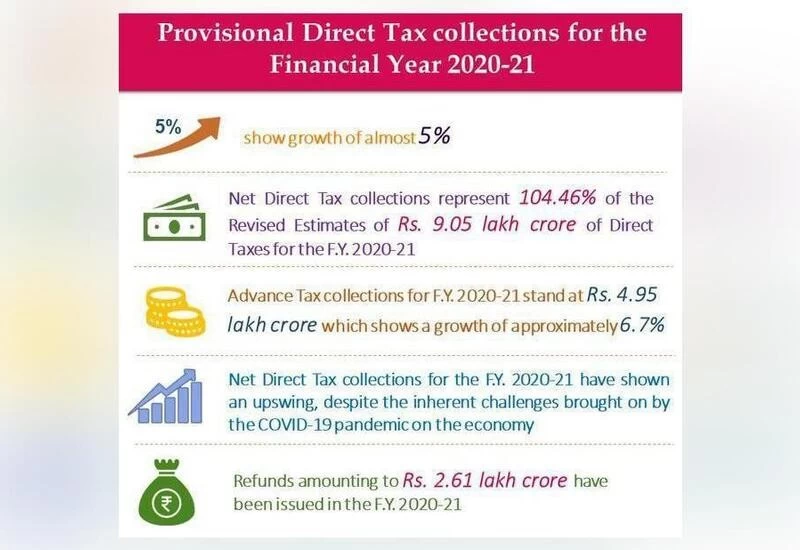

New Delhi: Direct tax collections for the financial year 2020-21 stand at Rs 9.45 lakh crore, which exceeds the revised estimates in Budget 2021, CBDT (Central Board of Direct Taxes) chief PC Mody said. The direct tax collections represent 104.46 per cent of the revised estimates of Rs 9.05 lakh crore direct taxes for the FY21, a finance ministry's statement said.

The direct tax collection comprises corporation tax worth Rs 4.57 lakh crore and personal income tax, including security transaction tax worth Rs 4.88 lakh crore.

The total direct tax collection before adjusting for refunds for the FY21 stands at Rs 12.06 lakh crore, including corporation tax at Rs 6.31 lakh crore and personal income tax, including security transaction tax at Rs 5.75 lakh crore.

The total tax collection before adjusting refunds comprises advance tax of Rs 4.95 lakh crore; tax deducted at source (including central TDS) of Rs 5.45 lakh crore; self-assessment tax of Rs 1.07 lakh crore; regular assessment tax of Rs 42,372 crore; dividend distribution tax of Rs 13,237 crore; and tax under other minor heads of Rs 2,612 crore.

"Despite an extremely challenging year, the advance tax collections for FY21 stand at Rs 4.95 lakh crore, a growth of 6.7 per cent over the advance tax collections of the immediately preceding financial year of Rs 4.64 lakh crore," a finance ministry statement said.

Refunds amounting to Rs 2.61 lakh crore have been issued in the FY21 against Rs 1.83 lakh crore in FY20, a 42.1 per cent rise over the preceding financial year. As per the ministry, these figures are provisional and may change after final collation of data.