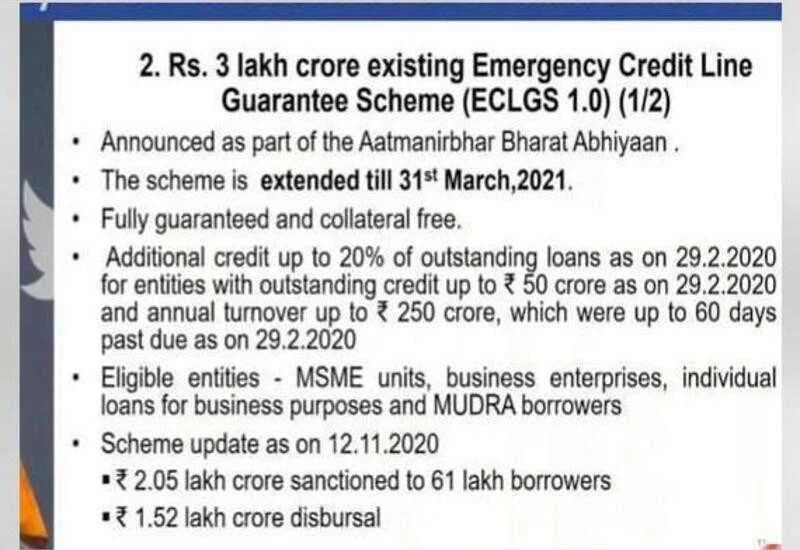

New Delhi: The Government on Thursday extended the Emergency Credit Liquidity Guarantee Scheme till March 31, 2021, a move that will be beneficial for millions of MSMEs in the country.

The scheme was initially supposed to end on October 30, 2020, but was subsequently extended by a month and was supposed to lapse on November 30.

In a press conference, Finance Minister Nirmala Sitharaman said a total amount of Rs 2.05 lakh crore has been sanctioned to 61 lakh borrowers, out of which Rs 1.52 lakh crore has been disbursed.

Eligible borrowers for the scheme include MSME units, business enterprises, individual loans for business purposes and MUDRA borrowers.

Announced as part of the Atma Nirbhar Baharat package in May to support micro, small and medium enterprises, the scheme provided fully guaranteed and collateral-free loans for amounts up to 20% of outstanding loans as of February 29.

The scheme was later expanded to include all business enterprises, individuals seeking credit for business purposes and MUDRA borrowers.