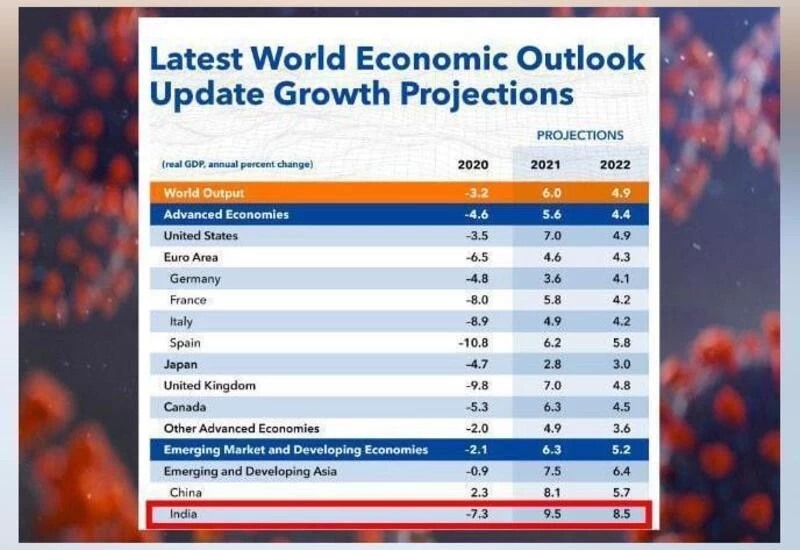

New Delhi: The International Monetary Fund (IMF) sharply cut its 2021-22 economic growth forecast for India by 300 basis points to 9.5% as Asia's third-largest economy's recovery has been set back severely following the second COVID-19 wave during March–May.

In its April review, the multilateral agency had pegged India's economic growth for FY22 at 12.5%.

"Growth prospects in India have been downgraded following the severe second COVID wave during March–May and expected slow recovery in confidence from that setback," the fund said in a statement on Tuesday.

India was hit badly by the second wave of coronavirus that overwhelmed the healthcare system and led to acute shortage of essential medicines, beds and oxygen supplies. The delta variant that led to a massive crisis in India has now spread to various parts of the world as well triggering fresh worries.

The fund maintained its 6% global growth outlook supported by improved outlook for the United States, Morocco, Latin America and Caribbean.

The fund, however, warned that slower than anticipated vaccine rollout could add to worries.

It also said slow vaccinations, inadequate policy response and withdrawal of easy monetary policy in western countries could lead to a double hit for emerging markets.

“A double hit to emerging market and developing economies from worsening pandemic dynamics and tighter external financial conditions would severely set back their recovery and drag global growth below this outlook’s baseline,” the fund maintained.

The fund said an immediate priority would be to deploy vaccines equitably and called for a $50 billion multilateral package as a feasible cost to end the pandemic.

On inflation, the IMF says it expects inflation to return to pre pandemic levels in most countries by 2022 but added that there could be a possibility of inflation being persistent forcing central banks to tighten earlier than expected.

"Clear communication from central banks on the outlook for monetary policy will be key to shaping inflation expectations and safeguarding against premature tightening of financial conditions. There is, however, a risk that transitory pressures could become more persistent and central banks may need to take preemptive action."