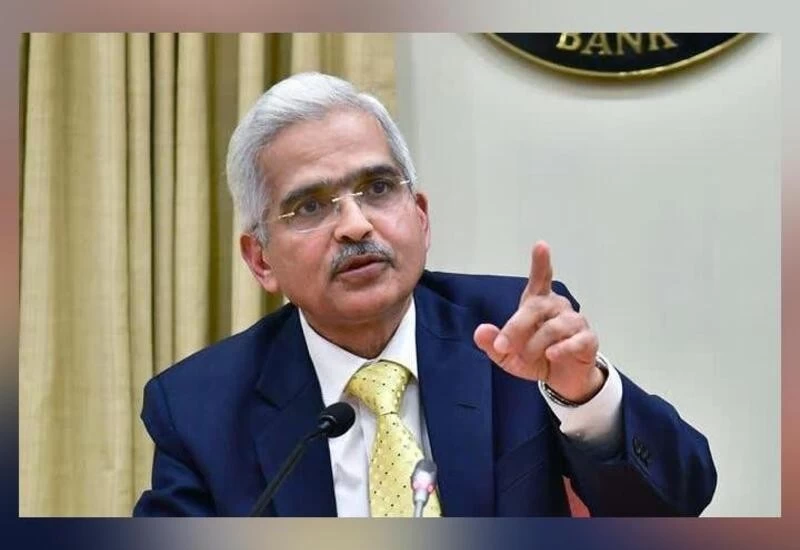

New Delhi: Government's decision to cut excise duty on petrol and diesel will have a positive impact on inflation, Reserve Bank of India (RBI) governor Shaktikanta Das said on Wednesday.

Addressing a conference, Mr Das said that food inflation is under control however core inflation continues to remain high. In such a scenario, the excise duty cut on petrol and diesel is significantly positive for inflation.

“That (excise duty cut on petrol and diesel) is significantly positive for inflation,” he said, adding that price rise in the country is mainly due to supply-side factors, which have been addressed by the government, he noted.

Government has looked into supply-side factors, especially in context of pulses and edible oils, and now very recently in context of petrol and diesel, Mr Das said.

“So, food inflation, by and large, looks to be now under control,” the RBI governor said.

The apex bank chief added further though that core inflation has remained elevated as far as India is concerned.

“So far as India is concerned, core inflation has remained elevated, and that is a policy challenge, and we are keeping a very close watch on the evolution of the core inflation,” he noted.

Even the fuel inflation has also remained elevated, and the RBI is closely monitoring it, Mr Das added further.

The central bank head also said that a large part of the liquidity infused during pandemic has already come back to RBI.

"Targetted long term repo operations (TLTRO) that we gave during the pandemic period has come back to the RBI and out of total liquidity that was injected, a large part of it has come back," he said in his speech.

In order to prevent excessive volatility in the foreign exchange market, the central bank had to intervene, which added a lot of liquidity during the Coronavirus-induced lockdown periods.

He also said that all the fiscal measures taken by the RBI to ensure adequate liquidity for all sectors hit by the pandemic, have proven quite effective.

Mr Das said this while emphasising that monetary policy normalisation or unwinding is not as simple as rolling back a carpet, and is a much more complex and long-term process.