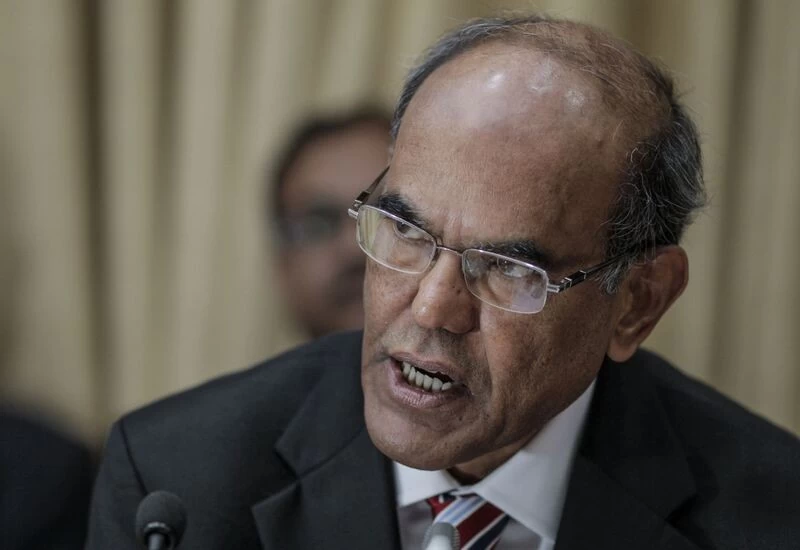

New Delhi: The country's economy, which is likely to contract by 5 percent in the current fiscal, may expand by around 5 percent in the next financial year, former RBI governor Duvvuri Subbarao said.

Rating agency Crisil on Tuesday had said the Indian economy may shrink by 5 percent in fiscal 2021, adding this recession could be the country's fourth since Independence and perhaps the worst to date.

"I do believe that getting up to 5 percent next year (FY22) is quite probable. The reason I say that is because this (COVID-19) is not a natural disaster. Our factories are still standing, our infrastructure and transport systems are still there," Subbarao said.

He was speaking at a webinar on 'Indian Economy - Navigating through a Crisis', organised by the Centre for Financial Studies (CFS) at Bhavan's SPJIMR business school.

"Once the lockdown is lifted and the economy is given a green signal to restart, I am sure that we can ramp up pretty soon and reach at least 5 percent (growth rate)," he said.

Speaking at the same webinar, former deputy chairman of the erstwhile Planning Commission, Montek Singh Ahluwalia, also said there is a possibility of 5-6 percent growth in fiscal 2021-22.

"But it would be mistake to treat that as recovery because if you are down 5 percent this year (FY21) and you are up 6 percent from that level then what it means is that during FY21-22 you will be at the same level as you were in 2019-20," Ahluwalia pointed out.

Subbarao further said a sharp decline in growth would mean a disruptive adjustment even for a rich country.

"For a poor country like us, it would mean enormous pain and hardship for millions of low-income persons, firms and enterprises, especially in the informal sector, going bankrupt and it could mean our financial stability becoming vulnerable," he added.

Amid this grim situation, the former RBI governor said he sees two silver linings -- relative stability of the external sector and bumper agricultural crop production, which would support the economy.

Commenting on the over Rs 20 lakh crore fiscal stimulus package announced by the government, Subbarao said, "Within the fiscal constraints of the government, they have done a good job."

He also lauded the government's decision of additional borrowing in this fiscal.

"I, for one, believe that the government should borrow more in order to spend more. That is a moral and political imperative. But I don't support the view that the government should resort to open-ended borrowing," Subbarao said.

The government has increased its market borrowing programme for the current financial year by more than 50 percent to Rs 12 lakh crore from the Rs 7.8 lakh crore estimated in the budget.

Subbarao added that the stress in the country's financial system could deepen post the coronavirus crisis.

"In January, before the COVID crisis hit us, we were extremely worried about our financial sector, health of our banks, NBFCs, NPA levels, trust deficit in private sector banks. All those parameters are going to get worse as we come out of this crisis," he said.

According to Ahluwalia, there is a need to undertake serious tax reforms that are long overdue.

"We should now set up a truly high-level multi-disciplinary committee of people advising the kind of tax policy to be announced in the next budget. It should include a serious re-examination of the GST where there are huge leakages taking place for a variety of reasons," Ahluwalia said.

The session was moderated by Ananth Narayan, associate professor (finance) at Bhavan's SPJIMR.