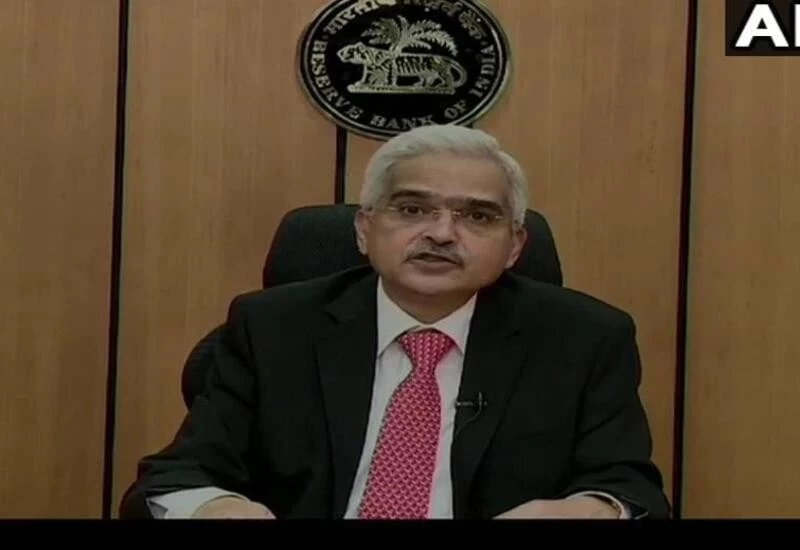

Mumbai: RBI Governor Shaktikanta Das on Friday in a statement announced a reduction in the repo rate by 75 basis points to 4.4 per cent while reverse repo rate is reduced by 90 basis points to 4%. The decisions were made during the RBI advances monetary policy committee meeting held between Mar 25-27 as country goes through tough times amid coronavirus lockdown affecting businesses and economy at large scale. Das said that the Monetary Policy Committee voted 4:2 majority to cut 75 basis points to 4.4 per cent.

The RBI Governor further said that macroeconomic fundamentals are stronger than those in the aftermath of the 2008 financial market crisis adding that the banking system in India is safe, deposits are safe in private banks, therefore, the public should not resort to panic withdrawal. Das added that living in an extraordinary situation, war effort needs to be mounted against coronavirus using conventional, unconventional tools. He further added that the RBI is at work and is calibrating action to meet any liquidity mode. The global slowdown can deepen with adverse implication for India, however, crude oil slump an upside indication for the country.

Repo rate reduced by 75 basis points to 4.4 per cent.

Reverse repo-rate reduced by 90 basis points to 4 per cent.

RBI permits all lending institutions to allow 3-month moratorium on payment of installments on term loans.

Rs 3.74 lakh crore liquidity to be injected into system through measures announced today.

CRR cut from 4 per cent to 3 per cent for all banks for a period of one year.

RBI announced that all Banks, HFCs, NBFCs are allowed 3 months moratorium for EMI.

Macroeconomic fundamentals are stronger than those in the aftermath of 2008 financial market crisis.

Banking system in India is safe and also deposits in private banks. People should not resort to panic withdrawals.