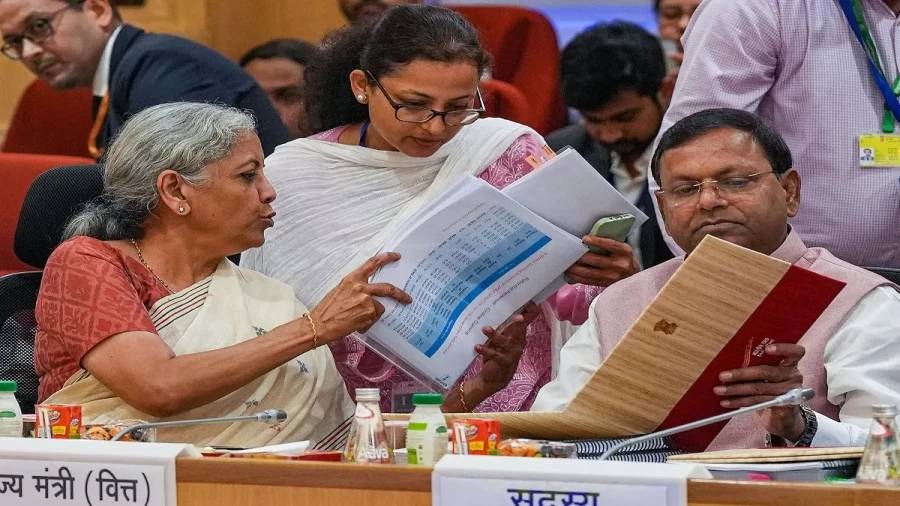

GST Council Meeting: The GST Council is preparing to give big relief to taxpayers in its 56th meeting. In this meeting going on in Delhi on 3 and 4 September 2025, a reduction in GST rates on health and life insurance policies is likely to be approved. According to a report by Moneycontrol, this move can make insurance policies cheaper, which will benefit the common people. Apart from this, tax exemption is also being considered on some life-saving medicines. The notification related to important rates is expected to be issued by the third week of September 2025.

Ease of compliance for MSME and startups

The meeting has laid special emphasis on providing relief to micro, small and medium enterprises (MSMEs) and startups. The GST Council has approved several measures to reduce the compliance burden on businesses. Now it has been decided to reduce the process of GST registration for MSMEs and startups from 30 days to only 3 days. This will provide relief to small businessmen from the delay in starting the business.

Additionally, a proposal has also been passed to settle the refunds stuck under the Inverted Duty Structure for textiles, pharma, chemicals, fertilizers and other industries in seven days. This move will prove to be helpful in improving cash flow for the MSME sector.

Proposal to increase GST on luxury electric vehicles

A proposal to increase the GST rate on luxury electric vehicles (EVs) priced above ₹ 20 lakh from the current 5% to 18% will be put up for discussion in the GST Council meeting. If this proposal is passed, major electric vehicle manufacturers like Tata Motors, Mahindra & Mahindra, JSW MG Motor, BYD, Mercedes-Benz, BMW and Tesla, which recently entered India, may get a setback. The move may be aimed at increasing revenue, but it may affect the demand for luxury EVs.

Demand for compensation for revenue loss

Eight states—Himachal Pradesh, Jharkhand, Kerala, Punjab, Tamil Nadu, Telangana, West Bengal and Karnataka—have requested the central government to compensate them for the revenue loss they may incur if the proposal to rationalise the GST structure is passed. This demand has been raised in view of the possible financial loss to the states due to changes in GST rates and exemptions.