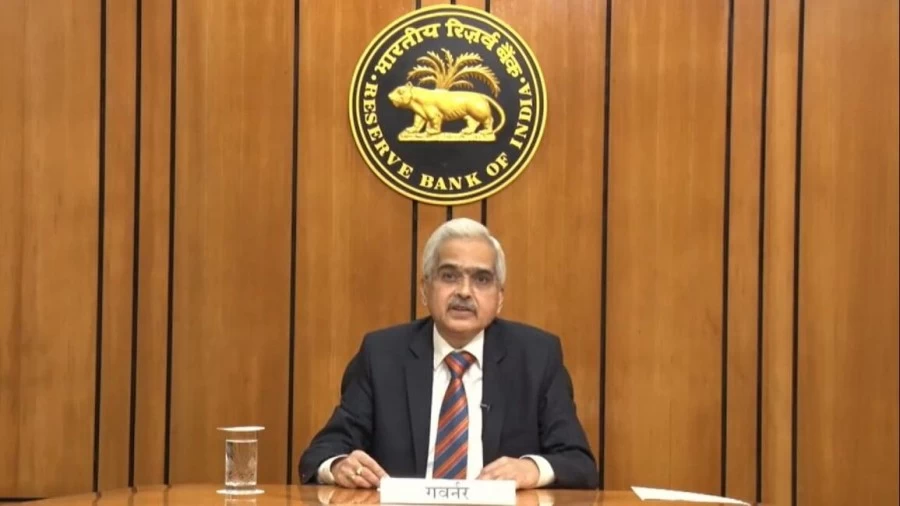

There is bad news for home-auto or personal loan borrowers. In fact, on Wednesday, the Reserve Bank of India (RBI), taking a big decision, increased the policy interest rates. That is, now loans will become expensive. Please note that these rates were unchanged from 22 May 2020. Giving information about the decisions of the meeting, RBI Governor Shaktikanta Das said that the policy repo rates are being increased by 40 basis points with immediate effect. Such a decision has been taken to control the rising inflation.

Repo rate raised to 4.40 percent

After this hike, the fixed repo rates at four per cent for a long time have increased to 4.40 per cent. Along with this, RBI has increased the Cash Reserve Ratio (CRR) by 50 basis points, to 4.50 per cent. The new rates have been implemented from May 21. Let us inform that the MPC voted unanimously on the proposal to increase the interest rates and after this Reserve Bank Governor Shaktikanta Das issued an order to increase. Das said that this step has been taken due to factors such as risk and increasing volatility in the commodities and financial markets.

EMI burden will increase on customers

It is worth noting that this increase in repo rates has come as a big blow to the customers taking loans. In fact, after increasing the rates, now home, auto and parcel loans will become expensive and the EMI burden will increase. Governor Shaktikanta Das says foreign exchange reserves are over $600 billion and debt-to-GDP ratio is low. Significantly, in the month of April, inflation has exceeded the Reserve Bank of India's forecast. If we look at the figures of March, the retail inflation in the country has reached a high of 6.95 percent, while the wholesale inflation is at a 17-month high.

Sensex falls over 1000 points

Let us inform here that the quick effect of RBI's decision to increase policy rates has been seen on the stock markets and the stock market, which is already trading with a decline, has fallen by filling it. The 30-share Sensex index of the Bombay Stock Exchange (BSE) fell 1000 points and reached below 56 thousand immediately after the decision. At present, the Sensex is trading at a low of 55,864, slipping 1070 points.

Inflation pressure will continue

All the six members of the Monetary Committee attended this meeting. Governor Shaktikanta Das presided over the meeting. Addressing after the meeting, Das said that the unprecedented high global food prices due to the prevailing geo-political situation have adversely affected the domestic markets. He said inflationary pressures are likely to continue going forward. RBI cautioned that while the Indian economy appears to be able to cope with deteriorating geopolitical conditions in the midst of the Russo-Ukraine war, it will face a crisis threatening geopolitical tensions, rising commodity prices and reducing external demand. We have to face the waves.

RBI meeting called suddenly

This meeting of RBI was not predetermined but was done suddenly and the decision taken in it is a big blow to the common man. Let us inform here that in the MPC meeting held on April 8, the repo rates were kept unchanged for the 11th time in a row. But the RBI governor had given indications of an increase in this at the same time. After the meeting, it was told that the members of the committee have discussed the rising inflation and the measures to control it.

It was estimated in earlier reports

Apart from this, in the report of research firm Nomura in the past, it was also estimated that the central bank may take a big decision to increase the repo rates to control the rising inflation. But this increase was expected in the report in the MPC meeting to be held in June. But the RBI surprised everyone by increasing the repo rates and CRR by calling a meeting in a hurry on Wednesday.