Mumbai: India’s central bank kept interest rates unchanged at a record low, as Asia’s third-largest economy faces fresh headwinds from a second wave of coronavirus infections.

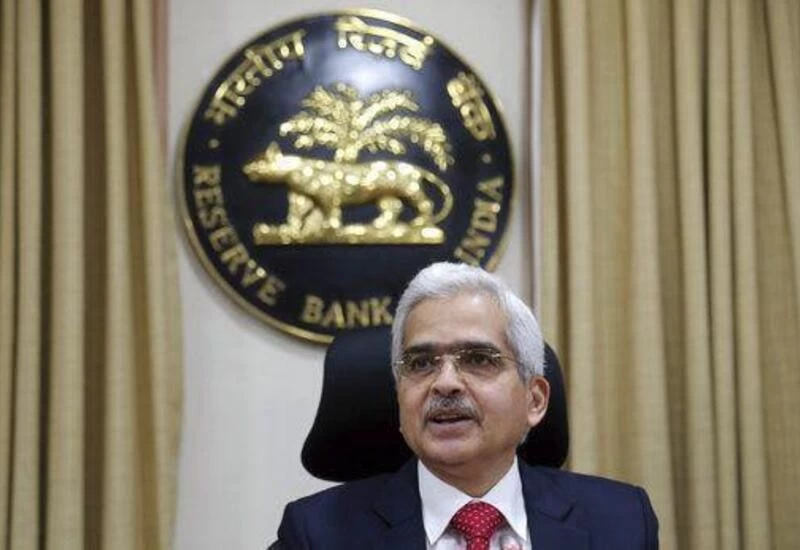

Governor Shaktikanta Das said the six-member Monetary Policy Committee held the benchmark repurchase rate at 4% — a decision predicted by all 30 economists surveyed by Bloomberg. The monetary panel will act to support growth by retaining its accommodative stance for as long as necessary, he said.

Policy makers had been expected to keep policy accommodative amid continued risks from the Covid-19 crisis. While a nascent recovery in Asia’s third-largest economy has been nudging inflation higher, daily new virus cases hit a record of more than 100,000 this week, pushing some states to impose movement curbs that could hit demand in an economy dependent on consumption.

The central bank also retained its growth outlook for the fiscal year started April 1 at 10.5%, unchanged from its February outlook.

“The recent surge in infections has, however, imparted greater uncertainty to the outlook,” Das said. “Localized and regional lockdowns could dampen the recent improvement in demand conditions and delay the return of normalcy.”

Bonds fell, with the yield on benchmark 10-year debt rising four basis points to 6.16%, while the rupee lost 0.2% to 73.60 per U.S. dollar. Stocks gained.

Although inflation at 5.03% in February was within the the central bank’s 2%-6% target band, sticky underlying prices pressures are also a problem for policy makers. That’s because higher fuel and volatile food prices, which make up more than 50% of the consumer price index, are causing second round effects.

The RBI revised the outlook for prices, with inflation seen at 5% in the fourth quarter of last fiscal year. That’s above the 4% midpoint of the central bank’s target band.

“Against this backdrop, the RBI should remain accommodative to support and nurture the recovery,” Das said. “The stance of monetary policy will remain accommodative till the prospects of sustained recovery are well-secured.”