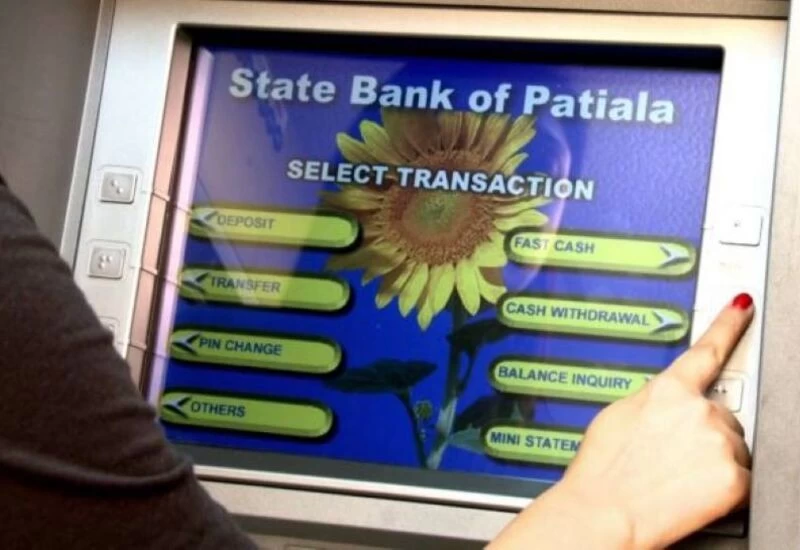

New Delhi: SBI ATM New Rule: If you are also the State Bank of India (State Bank of India) then it is news of this work. The bank has changed its many essential rules. According to the information received from the State Bank, using the Cash Withdrawal and Cheque Book from ATM after applying the new rule can prove to be expensive.

Changes in service charge

From July 1, there is a change in many rules of this biggest bank of the country. Actually, Bank India has shuffled the service charge to remove money from its ATM and bank branch. This information was given to the official website of SBI. According to this new charge will be applied to Chequebook), transfer and other non-financing transactions. According to the bank, the new service charge will be applicable to SBI Basic Savings Bank Deposit (BSBD) account holders from July 1, 2021.

Cash with ATM was also expensive

SBI's BSBD customer remains four-time free cash extract. After the free limit finish, the bank charged charging from customers. But after July 1, GST charging is also charged with 15 rupees on cash withdrawal from ATM. Due to the Corona Crisis, State Bank of India has increased the limit of cash removal by giving relief to his account holders. Customers will go to second branch from their savings account and can be removed up to Rs 25,000 through the Vidrall form and can be removed from 1 lakh rupees by going to another branch.

These changes in State Bank service charge

Significantly, the SBI BSBD account holders are given a copy of 10 checks in a financially. Now according to the new rule, now the charge will be charged on a checkbook with a checkbook. Now BSBD bank account holders will have to charge GST charging with 40 rupees for 10 check leaves, while there will be 75 rupees and GST charge for 25 check leaves. For 10 leaves of Emergency Checkbook, 50 rupees will be paid GST. However, the bank has exempted from a new service charge on the checkbook for senior citizens.