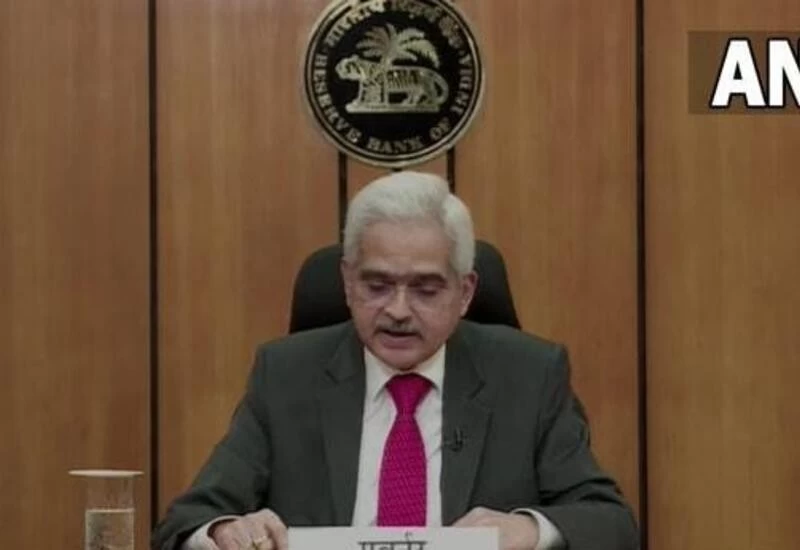

New Delhi: RBI Governor Shaktikanta Das on Tuesday asked banks to remain vigilant to any emerging signs of vulnerabilities and take timely steps to mitigate the risks.

In a statement, the Reserve Bank of India (RBI) said the governor held separate meetings in virtual mode with managing directors (MDs) and chief executive officers (CEOs) of public sector banks and some private sector banks (PSBs).

In his opening remarks, Das acknowledged the improved financial and operational resilience of the banking sector that imparts strength to financial stability. He, however, emphasised the need for banks to continue providing necessary support in the revival of economic activity.

Bankers aware of deliberation said heads of PSBs explained that the economic upturn outlook for credit expansion is better. They have taken steps to scale up credit through outreach programmes across states.

The RBI data showed that credit growth is improving, albeit at a slower pace. Banking systems loans expanded by 6.5 per cent year-on-year, till October 8, up from 5.7 per cent a year ago.

The governor also advised the banks to maintain the stability of not only the institutions themselves but also of the overall financial system.

Several other matters, including credit flows, especially to micro and small enterprises, were also discussed during the meetings.

According to the statement, discussions also took place on matters like outlook for stressed assets and measures for mitigation, pricing of risks, collection efficiencies and engagement of banks with fin-tech entities.

Bankers said the collections from regular and recoveries from bad loans have shown improvement. The incremental stress is expected to be lower due to emergency credit support and restructuring schemes. Also, the capital adequacy and provisioning for existing bad loans is comfortable.

CARE Ratings in review of Q2FY22 results of 23 banks said the asset quality situation of the Indian banking system does indicate a gradual improvement in the NPA ratio in September. For these 23 banks (nine PSBs and 14 private banks), gross non-performing assets (NPAs) have declined to 6.97 per cent from 7.21 per cent in March.

The implementation of certain regulatory measures for ensuring consumer protection were also taken up in the meeting. Asked if issue former SBI chairman Pratip Chaudhuri’s arrest came up for discussion, bankers said such a matter did not crop up in interactions.

RBI Deputy Governors M K Jain, M Rajeshwar Rao, and T Rabi Sankar also attended the meetings.