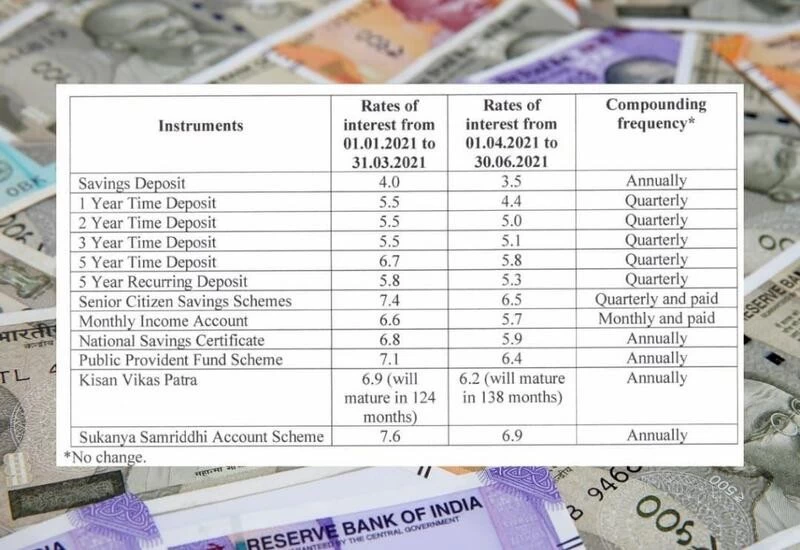

New Delhi: The government on Wednesday slashed interest rates on small savings schemes. According to the circular issued by the Finance Ministry, the rates of small savings schemes have been reduced by 50-100 basis points. Note that interest rates for small savings schemes such as PPF, SSY, SCSS, NSC, KVP etc. are reviewed and notified by the finance ministry on a quarterly basis.

The government has cut interest rates on small savings schemes after keeping them unchanged for the past three quarters. Interest rates on small savings schemes have been cut by massively (100 basis points/bps = 1%) for the first quarter of the financial year 2021-22. For first time since 1974, the PPF interest rate is now below 7%, a 46 year low.

After the latest cut, Public Provident Fund (PPF) will fetch interest rate of 6.4% from 1 April. The National Savings Certificate (NSC) will fetch an interest rate of 5.9%. The girl child savings scheme Sukanya Samriddhi Yojana will now fetch 6.9 per cent interest, down from 7.6 per cent earlier.Post office time deposit rates across tenures have been reduced by 0.40 to 1.1% and will earn in the range of 4.4- 5.3%. National Savings Certificate (NSC) rate has been slashed to 5.9 per cent from 6.8 per cent earlier.

The interest rate on Kisan Vikas Patra (KVP) has been retained at 6.2%. This is the second time the government has cut interest rates on small savings schemes in the past one year. In the April-June quarter of 2020-21, the government had slashed rates of small savings schemes by 70-140 bps.

With the latest cut, interest rates on small savings schemes have been reduced by a total of 120-250 bps during the current financial year.

It is worth adding that the nterest rates have been cut for the quarter due to the fall in the 10-year government securities (G-Sec) yield. The Shyamala Gopinath Committee had suggested that the interest rates of different small saving schemes should be 25-100 bps higher than the yields of the government bonds of similar maturity.